CREDIT REPORT & SCORE

You can obtain a copy of your credit report for NO FEE and review it for accuracy once a year. Credit reports are maintained by three credit reporting agencies: Experian, TransUnion and Equifax. www.annualcreditreport.com.

Under the Fair Credit Reporting Act, consumers have the right to review and contest information in their credit reports. If there is incorrect or missing information that would improve your credit score, report it to the credit bureau. www.federalreserve.gov/creditreports.

Credit bureaus compile individual reports of consumer debt through an array of sources, including credit card companies, banks, the IRS, department stores and gasoline companies, and any other entities granting loans. www.myfico.com.

Information on your payment standing for all the accounts you've held for the past seven to 10 years (seven years for accounts not paid as agreed and 10 years for accounts paid as agreed) are on your report.

Scores range from 300 (poor) to 850 (excellent), and the rule of thumb is the higher the score, the lower the risk to lenders.

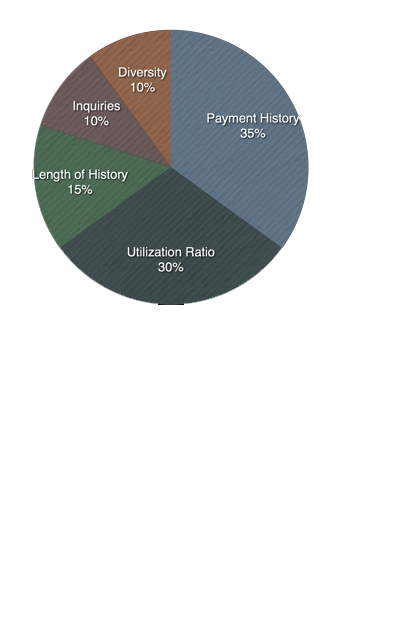

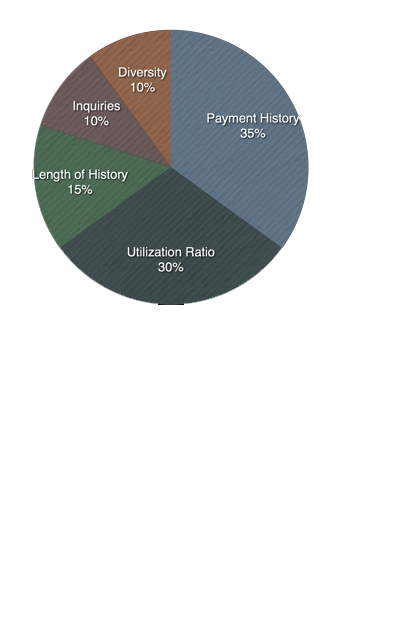

PAYMENT HISTORY: 35%

Public records such as tax liens and bankruptcy

Credit cards

Bills such as phone, electric, gas, etc.

UTILIZATION RATIO: 30%

Maxing out credit cards

Utilize multiple credit cards and carry low utilization

High achievers utilize about 7% of their limit only

CREDIT HISTORY LENGTH: 15%

Revolving account average

Generally closing any account is not good. May shorten average account age

High achievers average 19 years of history

INQUIRIES: 10%

Hard Inquiry such as credit extensions or rate shopping will impact negatively

Soft inquiries such as your own, employer, landlord, etc. has no impact

DIVERSITY: 10%

Diversity in different loans demonstrate that you can manage different types of accounts